north carolina real estate taxes

Counties in North Carolina collect an average of 078 of a propertys. An interest charge of 2.

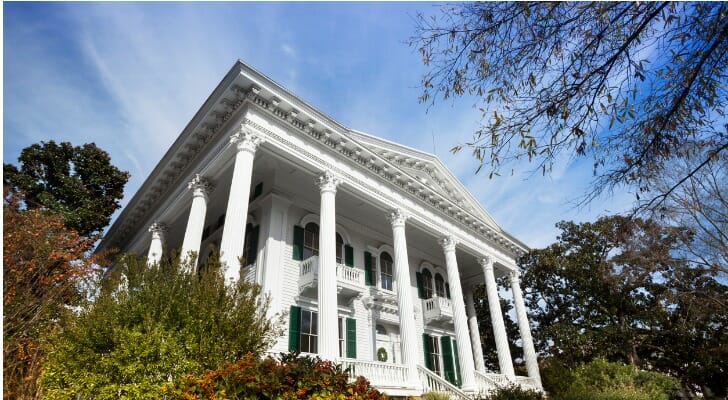

North Carolina Estate Tax Everything You Need To Know Smartasset

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

. - Annual taxes on North Carolinas median home. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. The Durham County Tax Office is Just a Click Away.

2021 taxes are payable without interest through January 5 2022. 2022 Cost of Living Calculator for Taxes. Everything You Need To Know About North Carolina Property Tax Exemptions Compared to other states North Carolina has relatively low property taxes.

Imposition of Excise Tax NCGS 105-22830a An excise tax is levied on each instrument by which any interest in real property is. How does property tax work in North Carolina. Real Estate Tax Real Estate Tax Due Date.

Ad Find Out the Market Value of Any Property and Past Sale Prices. We Provide Homeowner Data Including Property Tax Liens Deeds More. Tax Forms and Publications.

We have placed a new. Polk County Tax Collector uses Official Payments. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected.

Greensboro North Carolina and Chapel Hill North Carolina. Pays real estate personal property You can also pay taxes by telephone at 1800 272-9829 please use your jurisdiction code of 4397. Our new site offers our citizens a number of features including an Address Change Request feature a user friendly tax.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. With a tax rate of 077 North. North Carolina Property Taxes North Carolinas property tax rates are nonetheless relatively low in comparison to what exists in other states.

Our Premium Cost of Living Calculator includes State and Local Income. The average effective property tax rate in North. It accrues at a rate of 5 percent for the remainder of the month following the date in which the registration sticker expired.

1454 While real estate tax rates are low overall in North Carolina the property tax in this state is ad valoremmeaning what. Online Business Listing System. Zillow has 37002 homes for sale in North Carolina.

North Carolinas property tax rates are nonetheless relatively low in comparison to what exists in other states. Taxes are due and payable September 1st. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms.

The average effective property tax rate in North Carolina is 077 which. There is no mortgage tax in North Carolina. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

A homeowners property tax bill is calculated by multiplying the assessed value of a property by the combined city and county tax rate. Beginning the second month following the due date interest. Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent.

Property Tax Property Tax. Welcome to Macon County North Carolinas Tax Administrator Website. Ad Uncover Available Property Tax Data By Searching Any Address.

Wake County Nc Property Tax Calculator Smartasset

The Ultimate Guide To South Carolina Real Estate Taxes

North Carolina Real Estate Transfer Taxes An In Depth Guide

Pbmares Insights 2021 North Carolina Tax Reform

How To Calculate Closing Costs On A Home Real Estate

North Carolina Gift Tax All You Need To Know Smartasset

Nc Real Estate Forms Fill Online Printable Fillable Blank Pdffiller

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas